Disability Insurance: A Critical Conversation With Clients

Disability, like death, is never a fun subject to think about. But as a financial advisor, one of your missions is to help make your clients financially bulletproof, and disability insurance is a critically important aspect of their plan.

Most people rarely think about disability insurance. They look at it the same way they look at their health insurance, which they have through their employer and therefore feel good about their coverage.

However, as financial advisors, we all know that the group disability through an employer is better than nothing, but it’s rarely ever enough to cover most monthly household financial commitments.

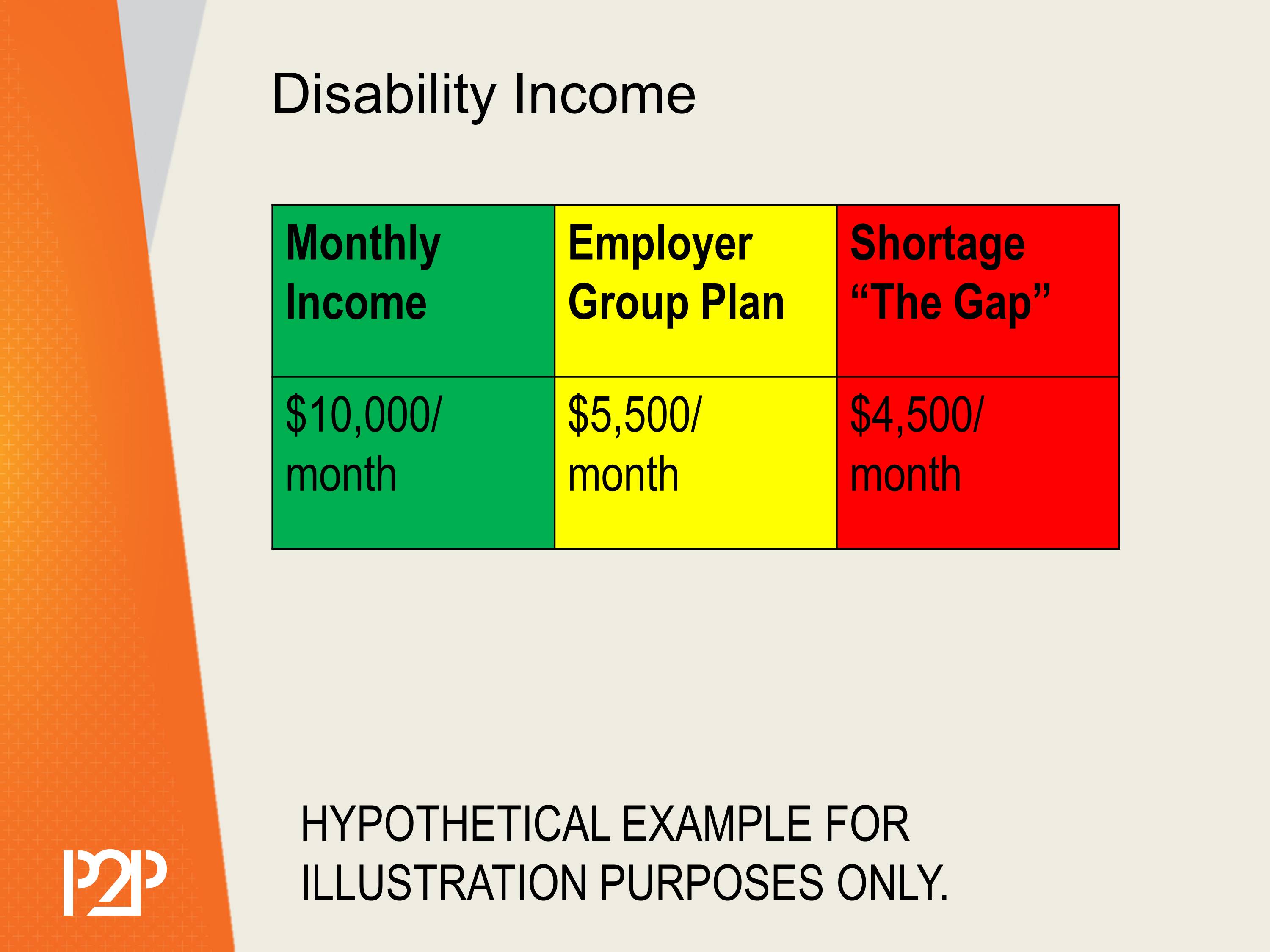

In my disability income planning process, I use a very simplistic approach. In a three-column spreadsheet, I use green figures in the left-hand column to illustrate the client’s net monthly income (after-tax and all deductions). Let’s say that figure is $10,000.

The next column, in yellow, displays the net amount coming into their household in the event of a disability, after-tax, through their employer group plan - let’s say $5,500.

The third column, color-coded red, shows the shortage between their group plan and their healthy ordinary income. Hypothetically, that number is $4,500.

With that amount presented, I’d say: “This green column is what you’re making now. In the event of a disability, this yellow column is what your household would receive, and therefore this red column is the Gap, which I see as a concern. Tell me before I move forward: How do you feel about that?”

Show Empathy, Yet Make Your Point Clear

This is where the rubber hits the road. Your goal is to make every one of your clients bulletproof, and if they don’t have adequate disability coverage, you must help them understand a vital fact: disability is more likely than premature death.

This fact can shock and upset them, but that kind of emotional response to the facts can propel them into action.

At this point in the process, I tell clients that there will be numerous components of the plan that are fun and exciting to discuss, but those come only after we hit our basic goals. I show empathy at this point by acknowledging that disability insurance is not fun, it’s more of a necessary evil. It’s as important as homeowner’s insurance or car insurance, which most people have, so I help them understand my conviction on this matter.

I also make clear that there are other problem areas in their disability planning besides the Gap in the graphs I highlighted. I inform them that most group plans have no index for inflation, so in the event of a long-term disability, the purchasing power of the dollar from their benefit will go down every year.

[perfectpullquote align="right" color="#dd7534"]But as a financial advisor, one of your missions is to help make your clients financially bulletproof, and disability insurance is a critically important aspect of their plan.[/perfectpullquote]

I also help them understand that most group disability does not cover beyond six months the cost of medical insurance, and I discuss the added cost of that aspect. Furthermore, I talk to them about having no contributions to retirement plans so, in the event of a long-term disability not impacting life expectancy, their life beyond 65 suffers because the group disability goes away, resulting in inadequate retirement funds.

I cover all these aspects of the disability section before moving forward. I explain that, looking at their situation, it seems obvious that they should at least be educated about the definitions and costs of a supplemental disability policy. I ask if we are on the same page and then remain quiet until they confirm. Otherwise, I’m probably not going to proceed further.

A Common Objection To Disability Insurance

Then, I address any issues or questions they have. One example might be:

“Jim, I’m a lawyer. I work at my desk. If I were disabled, I could just come to work because it’s not like I’m laying concrete. So, that’s not really a concern of mine.”

That would be an instance of an individual not relating to the real potential of a devastating disability. I would reply to the client:

“Mr. Prospect, I can understand and appreciate your position. I work almost exclusively in a white-collar world. Many of my clients feel the same way when we first meet. Having said that, let me ask you a question: When did you last have a 103° temperature or a bad case of the flu that prevented you from working?”

Posed that question, they quickly understand that, in the event of disability, whether it be a mild sickness or cancer, the last place they want to be is at their workplace. I simply remind them that great planning is all about having options. My job is to make sure you don’t have to go to work feeling miserable. With a small disability insurance premium, the option exists. Most of my clients grasp the concept when described to them in this manner.

A Critical Conversation With Every Client

Disability can be financially devastating to a family when it happens, and I believe everyone in this industry has an obligation to address it with their clients. In my practice, I made a commitment to myself to talk to every single client about disability insurance. To the extent that they chose not to take action, I would let it go, but I would make detailed notes in the case file that I did so.

This allowed me to sleep easy at night knowing that every client I worked with was educated about the risk and had an opportunity to put a plan in place.

[wd_hustle id=my-newsletter! type=embedded]

[Sassy_Social_Share type="standard" url="http://jimeffner.com/prospecting-ideas-built-business/"]