Addressing the Need for Life Insurance

Based on my overall financial philosophy, it is critically important that financial reps address risk management with their clients before wealth accumulation planning.

Regardless of any other planning, an untimely death of the breadwinner can derail a family’s goals. However, if we start with the life insurance, then add additional planning on top, we’ll have done a better job increasing a client’s financial security.

With this in mind, the first goal is helping clients understand the fundamental purpose of life insurance. When I was a financial advisor, I'd often hear my clients joke, “If I had that much life insurance, my wife would be better off if I was dead than if I was alive.” Although that might be funny, it’s nowhere near the truth.

Life insurance is NOT to make a widow wealthy, or wealthier, should a client pass away instead of living a long, healthy life.

The purpose of life insurance is to preserve a family’s lifestyle at the current moment in time in the event of an untimely death. It’s to maintain the status quo. When your clients understand that perspective, it allows us to set in on the meaningful goal of determining the right amount of life insurance for them.

Calculating Your Client’s Life Insurance Needs

Basic life insurance planning is broken down into three components. In no particular order:

1) The elimination of debt

2) Paying for education

3) The replacement of an income stream

There are other uses as well, such as philanthropic needs, family foundations, estate tax planning and so on. But those three are the most applicable to most people.

Before getting started with a client, I like to remind them of all the areas that the plan will not cover, such as home repairs, new cars and family vacations. They need to understand that by addressing these three core components, their family still will have to make a tremendous amount of sacrifices.

As a hypothetical example, let’s say $300,000 is what would be needed to pay off all the debt. Second, the client wants $25,000 in today’s dollars per year for four years for each one of their children. I will subtract out what they already have set aside and let them know the net present value today to fund the future college costs.

Then, last but not least, I will repeat to them the income replacement need that they stated to me. For example, “Mr. Prospect, out of the $10,000 a month that you’re currently living on today, you mentioned that if your mortgage was paid off that you wanted $7,500 a month for your wife until she’s 65 years old. Then, you would want $5,000 a month in today’s dollars until her life expectancy.”

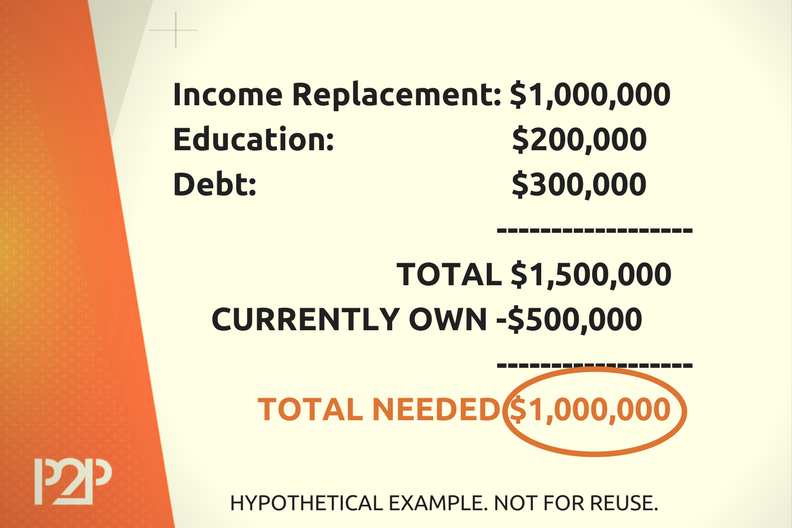

Next, I’m going to show them a single number, the net present value, of how much money needs to be set aside for income replacement. Then, I’d add the net present value single number for education. Then, I add in their debt. The three numbers added together make up the total capital required to meet their income, debt and education goals if the client were to pass away today.

Lastly, I’d subtract from that number what they currently have through work and have bought on their own. The difference is what they need. Below is an example of the format of those numbers.

Responding To Your Clients Feelings and Concerns

This is a really critical point in the planning process that most reps miss out on. Let’s just say that the final number comes to $1 million. I’d say, “Based on what you’ve told me and what we covered, $1 million is number required to satisfy the objectives we discussed. Before I go any further, how do you feel about that number?”

[perfectpullquote align="right" color="#dd7534"]The purpose of life insurance is to preserve a family’s lifestyle at the current moment in time in the event of an untimely death. It’s to maintain the status quo.[/perfectpullquote]

However the client answers that question is going to determine the next steps. For instance, they may say, “That makes a lot of sense. Although I’m not excited about the additional expense, I believe that you’ve done a good job and that’s the number I need.”

That happens about 5 - 10% of the time.

The other extreme is someone who says, “I’m not going to buy more life insurance. I have X amount at work and X amount on my own. I’m fine.”

This is where you have to be able to have a good enough relationship with your client to say:

“My job today is not to tell you what amount you need to buy. My job is to simply ask good questions, listen and then use my systems and planning materials to tell you what you need. So, having said that, the numbers are what the numbers are.”

“You can calculate these numbers six ways to Sunday, but based on what you currently have and what you told me your objectives were, $1 million is the amount you need. We don’t have to do that amount, but my job is to help you hone in on what the right amount is first.”

“Before we go any further, let’s go back to the debt, education and income replacement numbers and figure out where you feel comfortable lowering them.”

Then you be quiet.

Clients typically do not want to cut out education or give their spouse less income. I also would say, “I can understand and appreciate your hesitancy to own this number. $1 million to most people is a lot of money, but let me share what I think is really important in my practice as it relates to life insurance proceeds.”

“My job is to help you create a bucket for a fund that dictates your family’s future for the rest of their lives. The opposite bucket that most people think about is called a windfall profit. In other words, if you are healthy and working and you were to win the lottery, $1 million dollars would be a huge win. You would throw a big party and that would be a great feeling.”

“However, if I were to walk in today and give you a check for $1 million dollars, but in order for you to cash it you had to sign in blood that you would never work another day the rest of your life, how would you feel about that?”

Most would never cash that check. That’s when I’d say, “Exactly, but if God forbid you don’t make it home tonight, and your wife gets a check from the insurance company, she’s in the first bucket. It’s a much different bucket than the one of windfall profit.”

Last but not least, I let my clients know that if they don’t smoke and they’re in good health, that term life insurance is relatively cheap. If we go the least expensive route, it’s probably less than what they pay for car insurance. They shouldn’t get too hung up on the total number. Finally, we can take a deep breath and they feel much better about what they’re doing.

By the time you conclude your discussion, both you and your prospective client should be in sync knowing the exact amount they need to buy to accomplish what’s important to them. Although they might not be doing cartwheels over it, they understand it and they own it. The next step is discussing the different types of life insurance and what would be the best fit for the client.

[Sassy_Social_Share type="standard" url="http://jimeffner.com/addressing-life-insurance/"]

[wd_hustle id="my-newsletter!"]