Over the past year, I’ve worked with about 100 financial advisors who are in my Sales Cycle Mastery program. Once a month, I meet with them in small, 10-person groups to hone their sales and practice management skills, with the goal of achieving transformational growth.

In the final class, we conduct a “Year in Review” to reflect on the advisors' results and conclude the program. I am so excited by the results.

Not only did many advisors report significant growth, but their feedback about what had the biggest impact on their business was invaluable. The answers I received were fairly universal from advisor to advisor, and the gift of their responses is what I’ll share with you below.

First, however, I want to start out with a small sample of results to give you a general idea of what they were able to accomplish and show what these actions can potentially do for you.

| 2016 Premium | 2017 Premium | Growth Percentage | |

|---|---|---|---|

| Advisor 1 | $400,000 | $800,000 | 100% |

| Advisor 2 | $200,000 | $500,000 | 150% |

| Advisor 3 | $200,000 | $400,000 | 100% |

| Advisor 4 | $150,000 | $340,000 | 125% |

| Advisor 5 | $350,000 | $500,000 | 43% |

Having been in this business for nearly 30 years, I can tell you that these results are rare. It takes an unwavering commitment to hard work and continuous improvement.

It’s also worth mentioning that many advisors in this program did not experience any increase in production. Some even went backwards.

However, every one of them still felt that they had made tremendous progress and were confident that the numbers would reflect it going forward.

With this in mind, here are six steps that these advisors took to achieve transformational growth.

People don’t run businesses. Systems run businesses. People run systems. Put another way, you have to STOP winging it in your business.

For example, think about time management. Can you imagine a surgeon showing up to the hospital thinking, “Hmm... what should I work on today?” That would be absurd. Their day is planned down to the minute.

In order for you to maximize your performance, you’ll need a system for time management. You can see an example for time management here. But you’ll also need a system for prospecting, phoning, conducting your meetings and more.

Implementing systems to run their business, in a consistent manner in every segment of the sales cycle, was one of the biggest takeaways from advisors in my program. Once the system was in place, all they needed to do was get out of their own way and follow the system.

Most financial advisors are Type A personalities and are always running a thousand miles per hour. However, in order to experience true growth in your business, it’s imperative you take the time to work on your business, not always in it. I call this “Critical Think Time.”

Critical Think Time is all about setting aside time to think about your business and process an idea that you feel can give you substantial growth. This was covered more extensively in a recent post, and you can click here to learn more about Critical Think Time.

Have you ever been in a client meeting where you thought to yourself, “Let me feel this out and if everything goes right, maybe I’ll ask for a referral.” Then, when the time came to ask, all sorts of reasons popped into your head for why you shouldn’t ask for it, such as:

“The client would be doing me a favor”

“I don’t know enough yet.”

“I haven’t added value yet.”

These mental traps plague countless advisors, preventing them from reaching their full potential. You have to develop an empowered mindset to overcome it. With this mindset, your beliefs are that you operate from unwavering honesty and integrity, bring tremendous value simply in the questions you ask and provide a gift to people your clients care about by taking their referrals.

These beliefs cannot be faked – you have to believe them in every fiber of your being. When an advisor has these beliefs, you can see their back straighten, eye contact intensity increase, and their voice strengthen. It makes everything they do more effective and their job more fulfilling and enjoyable.

You can no longer do the things that got you to where you are today in order to reach your full potential in the future. Anytime you build a new system or begin a new process within your business, it will feel uncomfortable.

Think about how you felt the first day of school, when you started a new job or tried a new sport. You have to learn to embrace this uncomfortable, yet exciting feeling in order to achieve growth in your career.

Especially in today’s age, it’s important to find moments in your life to slow down. One example of this is the previously mentioned concept of “Critical Think Time.” Critical Think Time requires time away from working in your business, but the ideas that result from it can dramatically improve your efficiency, helping you grow faster.

Another example of slowing down to grow faster is in your fact finding, asking deeper questions in order to truly get to know your clients. Most advisors simply ask for basic financial numbers. They get a financial snapshot of their client, but they miss the story.

Truly understanding your clients takes additional time and energy. However, it can have a huge impact on the quality of relationships and help you create better referrals with greater ease. Click here for more on this example.

You can no longer do the things that got you to where you are today in order to reach your full potential in the future.

When first building their practice, most advisors bring on as many clients as possible. However, as the business starts to grow, the focus must shift from quantity to quality.

While everyone’s practice is different, consider the example that the number of clients an advisor should have should max out at around 400. However, the quality of those clients should continuously grow. The average caliber of the individuals that come into your system continues to increase, while the individuals that no longer meet your minimum criteria are substituted out.

Under this method, your practice continues to grow in terms of enjoyment, fulfillment and revenue, but it doesn’t necessarily increase your work load.

...

The common thread that runs through these six steps is that they all involve running your business with a high level of intentionality. Taking time for critical thinking, developing systems for your business, developing your core beliefs; these are all things that are easily lost amid the daily shuffle.

But you should heed the wisdom of these financial reps who were able to make big leaps in a single year. These practices worked for them and, most importantly, are backed by proven results.

Most financial advisors are Type A personalities and are always running a thousand miles per hour. However, in order to experience true growth in your business, it’s imperative you take the time to work on your business, not always in it. I call this "critical think time."

Critical think time can make the time spent working in your business more efficient, productive and profitable. It creates a greater sense of intentionality to your actions, rather than just reacting to daily unimportant time wasters.

Throughout my career as a rep, manager, speaker and consultant, critical think time has always been the fuel for my business. As a rep, I’d sit down and think of ways that I could expedite referrals or think of great questions that I could ask during my fact finding meetings with clients. This allowed me to build deeper relationships with my clients in less time and build my practice at a high level. The entire framework for my consulting business today, P2P Group, is a result of my critical think time.

This past month I concluded one of my Sales Cycle Mastery programs. It’s a one-year program where I meet with a small group of top advisors once a month to teach my sales approach. As they reported their results, we received incredible feedback, some of which was on critical think time. One rep told me that it was, “Hands down, the biggest takeaway from the training and a complete game changer.” It’s allowed him to become a more effective leader and build better relationships with his staff.

There are also numerous examples of some of the world’s most successful business leaders who use concepts similar to critical think time, from Warren Buffet to Mark Zuckerberg and Bill Gates. Despite the enormous demands on these individuals, they still intentionally set aside time to think. There’s no excuse for why you can’t too.

At the end of the day, I simply recommend that you give critical think time a shot and commit to doing it for a period of time. It can completely transform your practice and your life and the cost of NOT doing it – missing out on transformational business-building ideas – far outweigh the minimal time investment.

The first step to employing successful critical think time in your business is to schedule it on your calendar. I schedule a couple hours a week for it, but one hour a month should be the minimum.

You should do it in a distraction free environment, such as a Starbucks or hotel lobby. If you do it in your office, make sure you’re in a closed off space and people know not to interrupt you. Disconnect from your phone and email.

I always get a smile on my face when I convince reps to try it. They do it and then they come back to me and say that they did it, but once they started the process they didn’t know what to think about! So the real question is, “What is critical think time?”

It is setting aside time to think about your business and process an idea that you feel can give you substantial growth.

Throughout my career as a rep, manager, speaker and consultant, critical think time has always been the fuel for my business.

Ideas like this often can’t be conjured on demand, so you should not go into this process simply with good intentions. Ever since my days as a rep, I always kept a pad of paper in my desk drawer. I would write ideas down as I thought of them. When my scheduled critical think time arrived, I had a list of ideas that I could choose from and I would pick one to work on.

There are countless ideas that you can think about, but here are a few questions you could use to get started:

1) What is it I need to do differently in my networking or prospecting processes to double my average income in the next 6 months?

2) If I was given $100,000 tomorrow, how would I invest it in my business? What return on investment could I expect from it?

3) Hypothetically, consider “billable hours” spent on revenue producing tasks. These billable hours consist of every hour spent with a client and one hour for every 30 prospecting calls. What is my billable hour percentage over the last 90 days?

Ex. An average of 10 meetings (10 hours) and 150 calls (5 hours) per week = 15 weekly billable hours. Based on a 50 hour work week, your billable hour percentage is 30% (15 / 50 = 0.3).

4) Once the billable hours have been calculated, what do I need to do to double my percentage of billable hours?

5) If I were to fire my staff tomorrow and was forced to hire a new person next week that costs double the salary, what would I look for in their traits and skills sets? Does my current staff person have those skill sets?

After you’ve concluded your session, you need to meet back with your staff and share with them:

• What it is that you are going to do

• Why it is that you are going to do it

• How it is going to benefit them

• How you need their help to make it happen

Last, but not least, you need to agree with them on how you are going to meet on these objectives on a regular basis and bring that sustainable change to life.

Critical think time can be an incredibly powerful tool. Implement it in your practice and watch how it can transform your true potential into real performance.

Based on my overall financial philosophy, it is critically important that financial reps address risk management with their clients before wealth accumulation planning.

Regardless of any other planning, an untimely death of the breadwinner can derail a family’s goals. However, if we start with the life insurance, then add additional planning on top, we’ll have done a better job increasing a client’s financial security.

With this in mind, the first goal is helping clients understand the fundamental purpose of life insurance. When I was a financial advisor, I'd often hear my clients joke, “If I had that much life insurance, my wife would be better off if I was dead than if I was alive.” Although that might be funny, it’s nowhere near the truth.

Life insurance is NOT to make a widow wealthy, or wealthier, should a client pass away instead of living a long, healthy life.

The purpose of life insurance is to preserve a family’s lifestyle at the current moment in time in the event of an untimely death. It’s to maintain the status quo. When your clients understand that perspective, it allows us to set in on the meaningful goal of determining the right amount of life insurance for them.

Basic life insurance planning is broken down into three components. In no particular order:

1) The elimination of debt

2) Paying for education

3) The replacement of an income stream

There are other uses as well, such as philanthropic needs, family foundations, estate tax planning and so on. But those three are the most applicable to most people.

Before getting started with a client, I like to remind them of all the areas that the plan will not cover, such as home repairs, new cars and family vacations. They need to understand that by addressing these three core components, their family still will have to make a tremendous amount of sacrifices.

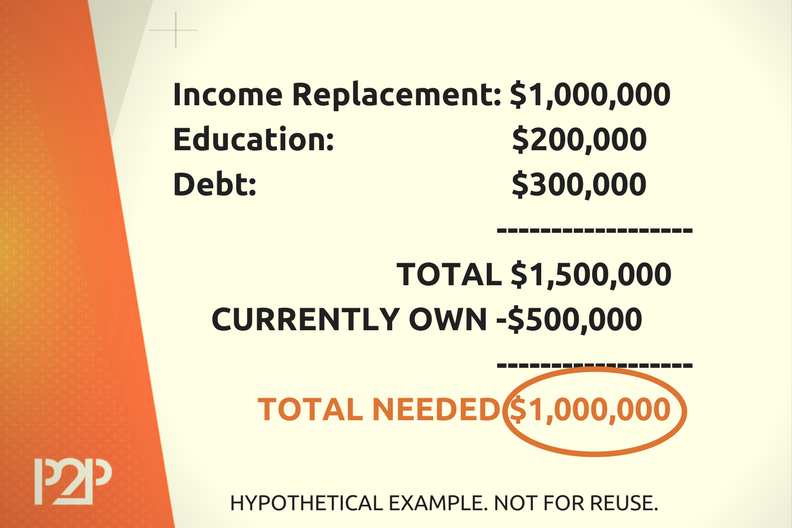

As a hypothetical example, let’s say $300,000 is what would be needed to pay off all the debt. Second, the client wants $25,000 in today’s dollars per year for four years for each one of their children. I will subtract out what they already have set aside and let them know the net present value today to fund the future college costs.

Then, last but not least, I will repeat to them the income replacement need that they stated to me. For example, “Mr. Prospect, out of the $10,000 a month that you’re currently living on today, you mentioned that if your mortgage was paid off that you wanted $7,500 a month for your wife until she’s 65 years old. Then, you would want $5,000 a month in today’s dollars until her life expectancy.”

Next, I’m going to show them a single number, the net present value, of how much money needs to be set aside for income replacement. Then, I’d add the net present value single number for education. Then, I add in their debt. The three numbers added together make up the total capital required to meet their income, debt and education goals if the client were to pass away today.

Lastly, I’d subtract from that number what they currently have through work and have bought on their own. The difference is what they need. Below is an example of the format of those numbers.

This is a really critical point in the planning process that most reps miss out on. Let’s just say that the final number comes to $1 million. I’d say, “Based on what you’ve told me and what we covered, $1 million is number required to satisfy the objectives we discussed. Before I go any further, how do you feel about that number?”

The purpose of life insurance is to preserve a family’s lifestyle at the current moment in time in the event of an untimely death. It’s to maintain the status quo.

However the client answers that question is going to determine the next steps. For instance, they may say, “That makes a lot of sense. Although I’m not excited about the additional expense, I believe that you’ve done a good job and that’s the number I need.”

That happens about 5 - 10% of the time.

The other extreme is someone who says, “I’m not going to buy more life insurance. I have X amount at work and X amount on my own. I’m fine.”

This is where you have to be able to have a good enough relationship with your client to say:

“My job today is not to tell you what amount you need to buy. My job is to simply ask good questions, listen and then use my systems and planning materials to tell you what you need. So, having said that, the numbers are what the numbers are.”

“You can calculate these numbers six ways to Sunday, but based on what you currently have and what you told me your objectives were, $1 million is the amount you need. We don’t have to do that amount, but my job is to help you hone in on what the right amount is first.”

“Before we go any further, let’s go back to the debt, education and income replacement numbers and figure out where you feel comfortable lowering them.”

Then you be quiet.

Clients typically do not want to cut out education or give their spouse less income. I also would say, “I can understand and appreciate your hesitancy to own this number. $1 million to most people is a lot of money, but let me share what I think is really important in my practice as it relates to life insurance proceeds.”

“My job is to help you create a bucket for a fund that dictates your family’s future for the rest of their lives. The opposite bucket that most people think about is called a windfall profit. In other words, if you are healthy and working and you were to win the lottery, $1 million dollars would be a huge win. You would throw a big party and that would be a great feeling.”

“However, if I were to walk in today and give you a check for $1 million dollars, but in order for you to cash it you had to sign in blood that you would never work another day the rest of your life, how would you feel about that?”

Most would never cash that check. That’s when I’d say, “Exactly, but if God forbid you don’t make it home tonight, and your wife gets a check from the insurance company, she’s in the first bucket. It’s a much different bucket than the one of windfall profit.”

Last but not least, I let my clients know that if they don’t smoke and they’re in good health, that term life insurance is relatively cheap. If we go the least expensive route, it’s probably less than what they pay for car insurance. They shouldn’t get too hung up on the total number. Finally, we can take a deep breath and they feel much better about what they’re doing.

By the time you conclude your discussion, both you and your prospective client should be in sync knowing the exact amount they need to buy to accomplish what’s important to them. Although they might not be doing cartwheels over it, they understand it and they own it. The next step is discussing the different types of life insurance and what would be the best fit for the client.

[wd_hustle id="my-newsletter!"]

When you begin a fact finder interview with a new prospective client, you want to open the meeting by describing what you do, how you do it and why you do it. This is known as the approach.

Over the course of my career, I’ve conducted several thousand fact finder interviews personally and taught hundreds of other reps how to do them. Needless to say, over time, I was able to master my approach to the point where I could give it in my sleep. You can click the video above to see and hear exactly how I gave my approach, or read on for more detail.

The purpose of the approach is to be able to flip the client’s negative mindset to positive in the first 3 - 5 minutes. Not all of your new prospective clients are coming in skeptical or distrustful, but I think you will be better served if you just assume that 100% of them are.

They're currently thinking to themselves, “How quickly can I get out of this? This person’s just going to try to sell me something. This person isn’t honest…”

Unfair or not, that’s the negative mindset. By the end of your approach, they should be sitting on the edge of their chair wondering, “Where has this person been all my life? I wish we would have met a long time ago. This is exactly what I need. This is the type of person that I could see myself working with.”

This is achieved partially through your language. More importantly, it’s done in how you deliver the approach and make the person feel. Just like anything I teach, this cannot be acting, it must be genuine.

While my language can serve as a starting point, you should put some real time and energy into crafting a version that feels authentic to you.

When you deliver your approach, the message must be clearly reflected in your voice, tone, body language, posture, the smile on your face and the eye contact you make with them. This displays your passion, purpose and genuineness in the deepest part of your heart.

You’ll never get a second chance to make a first impression, so make sure you take the time to master your approach. Practice it with other reps in your office until it feels natural, so that you can focus on delivering it with energy and you're not just trying to remember the words.

[wd_hustle id="my-newsletter!"]

The success of a new client meeting is often determined within the first 10 minutes.

However, have you ever considered what your prospective client is thinking?

They may be nervous, indifferent or even distrustful.

It's your job to create a 180 degree shift - transforming their negative thoughts into real excitement about the opportunity to work with you.

That's what my new training video is all about.

Based on my 27+ years of experience in financial services, I've found there are three keys to creating this shift.

These three keys helped me to become a lifetime MDRT qualifier as an advisor.

They increased production for the 117 full-time financial reps that I led as a managing partner.

Now, as a speaker and trainer, they've helped hundreds of top reps around the country - they can help you too.

Sign up below to access my free training video: Start Strong: Master the First 10 Minutes of a New Client Meeting.

We’ve all been there before. You’ve just had a great fact finder meeting with a prospective new client.

You’ve delved into the numbers and have a solid understanding of their story, finances and goals moving forward.

You’re winding down the interview and you think to yourself, “Now what…”

You just spent an hour to an hour and a half with your prospect. You’ve covered a lot of ground and asked many questions.

But, if you don’t close the meeting with intentionality, the likelihood of your prospect becoming a client is greatly reduced – a waste of both your time and your clients’.

At the end of the meeting, it’s up to you to tie everything together and set the direction.

According to a study conducted by MIT AgeLab, the factors that clients value most about their financial advisors are personalization, expertise and empathy.

Put another way, your clients want to feel that you understand them, genuinely care about them and are knowledgeable about the profession you’re in.

You can demonstrate all of this by concluding your meeting using what I call a “Discovery Agreement.”

The purpose of the Discovery Agreement is to provide an executive summary of the meeting that addresses:

1) What was covered during today’s fact finder meeting

2) Why they should come back for another meeting

Doing so demonstrates that you truly listened to them and that you are a professional. It also helps to create an appropriate sense of urgency for the next meeting.

Here is an example of my approach:

I would tell my prospect, “We spent an hour and a half together today and we covered a lot of ground. Before I leave, let me sum up what I learned to make sure we’re on the same page for when we get together next time.”

Then, I would review the main topics that we covered. Here’s a hypothetical example:

“First, we discussed the goals that you and your spouse have for your three children’s education. You told me that it was important for you to pay 50% of the total cost for four years of college for each of them. You told me the story of how your parents did that for you and you felt that’s what you wanted to do for your kids. We will look at potential options to accomplish this goal.”

“The second thing we talked about was your retirement. You haven’t thought much about retirement yet but you understand how important it is to start planning now. We used a retirement benchmark of 65 years old at 80% of the income that you’re making right now, and you gave me the current balances of your 401(k) and IRAs. I will review that information to see where we are.”

“The third topic we talked about was life insurance and protecting your family in the event of an untimely death. God forbid you don’t make it home tonight, what would your household need for them to be financially sound? You had mentioned that you wanted to have $4,000/month until your spouse is 65 years old, and you still wanted to provide 50% of the college tuition for your three kids. You told me about the life insurance you have at work and the individual policy you bought from your multi-line agent. I will review these policies and see if it meets your needs.”

“Fourth, we talked about what would happen if you suffered an illness or injury and became disabled. You said that you have disability insurance through work. I will see if this amount would be sufficient in the event of a disability and we can discuss if there are any gaps that need to be covered.”

“As a next step, I’m going to take all the information discussed today and put together a plan that will give you the 30,000 foot perspective of your family’s financial life. It will give you a clear understanding of what we need to do for you to get an “A” in each one of those categories we discussed. My clients love seeing this plan and I’m excited about showing it to you. But, before I leave, is there anything I missed in that wrap up or are we on the same page?”

Your Discovery Agreement should cover each of the major categories of the meeting. You are summarizing what was discussed and then providing the next steps – that’s it.

Do not go into real detail with it or you’ll risk making it overwhelming instead of helpful.

First off, you never want to leave the next meeting date open ended. If possible, book it with them before they leave the office.

One potential obstacle is if your prospect wants their spouse at the next meeting, but doesn’t know their schedule. In this case, have them make an educated guess. Better to have to reschedule than to leave the meeting without a date for the next one.

At the end of the meeting, it’s up to you to tie everything together and set the direction.

In addition, you should write down any key information that you still need from the client. Provide a copy to them and let them know that you will follow up if you don’t have it in a short period of time.

Finally, shake their hand and conclude the meeting.

Remember, at the end of the meeting, the most important thing is that your clients feel that you understand them, care about them and are knowledgeable.

The Discovery Agreement will help you nail these objectives and set yourself up for a positive client relationship.

[wd_hustle id="my-newsletter!"]

I don’t remember much of age 22. My first year as a financial rep was one of long hours and nights with little sleep.

However, I do remember with great clarity the night I accepted my Rookie of the Year award.

It was a black-tie affair at a beautiful hotel in downtown Chicago. I gave a 3-4 minute speech in front of the leaders of one of the most prestigious financial organizations in the world.

I told everyone how fortunate I was to have found a career that I knew I would have for the rest of my life.

Unbeknownst to me, the CEO of our company was a guest of honor at that dinner. I was stunned when he stood up afterwards and said that my words had moved him.

It was a high point that fueled my 27+ year future in this industry.

I am often asked how I became successful so early in my career, and sustained it over the years. While there is no single magic bullet, here are four important lessons I learned early on that I believe are applicable whether you are brand new in the business or a 30-year veteran advisor.

Being from a middle-class family and a C student, with no connections, I was looking for a job that would provide opportunity.

I felt an excitement for selling insurance from my very first interview. Here was a job with unlimited income potential, where I would be doing real work and have a life-changing impact on the clients I served.

I learned very quickly that the individuals who made it at the top were those who worked the hardest, driven by passion and purpose. You’re not measured in this business by your seniority or a fancy degree, but by activity, results and a willingness to get comfortable with the uncomfortable.

On the door of my bedroom, I wrote MDRT and Rookie of the Year to keep me striving towards these goals every day. I achieved both that first year, and qualified for MDRT each year after.

I knew that I might not be the smartest, the best salesman, or the most connected, but there was no way I was going to let anybody outwork me.

You need good mentors that you can learn from in your career. I was fortunate to be surrounded by people who were not only MDRT members, but were also Court of the Table and Top of the Table.

Having these role models was significant. They set the bar high and led by example. Seeing people 20 or 30 years my senior achieving the success I dreamed of, in the very hallways I walked each day, was extremely powerful. I wanted so badly to become like them.

Every day, they would tell me about the importance of life insurance, disability insurance and saving money. They would share stories of what they had done for their clients. It didn’t take long to embrace the mission: helping others achieve financial security.

I did a lot of joint appointments that first year and I was always able to pull one or two nuggets of wisdom out of each. I was like a sponge. You’ll often hear me say that everything I know now, I learned from others.

One of the most important things that differentiated my success was how I dealt with the bad times. Almost anyone can perform well in good times. The commissions are rolling in and life is grand.

Yet, it was not the victories, but the multiple challenges I faced and how I overcame them that was crucial. When you’re in a trough, it seems like nothing goes right: appointments cancel, clients reverse their policies, and you spent a commission before it came in.

The only remedy that worked for me was sustained activity. That’s what kept me going during tough times. I always felt better when I had a phenomenal amount of activity.

I would have a dozen referrals, keep 5 or 6 appointments, which would open up a couple of cases. I was back on top, and consistent activity was the medicine that made the pain go away. It was better than a commission check in my mailbox.

Lastly, I learned early on the importance of building solid relationships with clients based on trust. A high level of trust, in turn, meant clients would be much more inclined to follow my advice.

I learned very quickly that the individuals who made it at the top were those who worked the hardest, driven by passion and purpose.

One way to begin a trusted relationship is to provide added value. When I would have an initial factfinder meeting, I would try to find key points where I could provide information that I knew the clients would find valuable.

An example of this was obtaining a client’s employee benefits booklet and reading through it from cover to cover. Most people never take the time to look at it.

Studying the booklet helped me gain an understanding of their pension, 401(k), group life, and disability insurance. Explaining these benefits and the associated rules to my clients provided tremendous value and helped build trust, which increased the chance that I’d retain them over the long term.

Additionally, this became a great source of referrals for me. After helping one employee understand their benefits, word naturally spread, and I became the go-to source for the client’s co-workers.

Over 27 years later, I am still as excited about this business as the day when I accepted the Rookie of the Year award. I’ve been blessed to work as an advisor, a managing partner and now as a speaker and trainer. This business allowed me to live the life I always imagined – and it can do the same for you.

Whether you are new to this industry or a seasoned veteran, keep in mind that we all have days that are a grind. But, you are in control.

Regardless of your triumphs or setbacks, you control your effort and activity. With a little luck, you can surround yourself with people that challenge and support you. You can always do what’s right and go the extra mile for your clients. Doing so is the key to gaining their trust and generates the greatest return on investment: the career of a lifetime.

One important aspect of taking a good fact finder is to gather key pieces of data from your prospect. Without an understanding of their current income, assets and liabilities, you can’t help them to formulate a plan to achieve their financial objectives and protect their family from the unexpected.

In my 27+ years of working with advisors, I have found that many fall into the habit of simply writing down these numbers – but they don’t take the time to understand the importance of the story behind them. To me, it’s like the difference between a snapshot and a movie. A snapshot is just a moment in time – but a movie tells you the whole story.

Consider that two clients could be in identical financial situations, but have arrived there as a result of dramatically different circumstances, decisions and behaviors. For example, take a 30-year-old client who has $50,000 in his savings account.

In one situation, a client was frustrated by overspending in his early twenties. He committed to saving $1,000 per month for the past four years, and has accumulated $50,000. Here is someone who has successfully made a major life change for the better. He is now a saver and sticks to the plan.

Compare this to a client who inherited $200,000 from his grandfather two years ago, but blew most of it on lavish trips and gambling. He’s down to $50,000 and is depleting his resources at a rapid pace.

Same number. Very different stories.

Financial security is a journey of 20, 25 or even 30+ years. It’s our job to help our clients make it to the Promised Land. This means that, in the long run, the number in a client’s savings account today is far less important than the story behind it.

The key is to ask questions, listen and continue to follow up until you have the movie – not just a snapshot.

Another opportunity for you to dig deeper in your fact finding is with your client’s salary. A salary is not that significant by itself. Again, it’s just a number.

In the long run, the number in a client’s savings account today is far less important than the story behind it.

Monthly net cash flow is far more important than gross salary. So, start with the amount that gets deposited in their checking account after taxes and health insurance.

Then, ask how much is spent on the mortgage or rent, as well as discretionary and non-discretionary expenses. Factor in their debts and you’ll quickly be able to calculate how much they have left to save and invest.

One recent article highlighted the finances of a couple with an annual household income of $500,000. Similar to their story, some of your clients with an expensive lifestyle may feel as if they are just “scraping by,” even with a high income.

Your job is to ask the right questions to help them understand their reality and determine what that means based on their financial goals.

Past behavior can give you great insight into your client’s current circumstance. However, it’s also important that you explore any foreseeable changes in your client’s future.

Are your clients in a long-term relationship? Planning on getting married? Or, are they married but in the process of a divorce?

Do they want to have children or additional children?

Are their children approaching college? If so, do they want to go to college? Or, are they nearing college graduation?

Do your clients love their jobs and plan on working part-time once in retirement?

Or, do they hate their jobs and can’t wait to cut back on hours, retire as early as possible or switch careers at some point?

Are their parents still alive? Are they in good health? What sort of relationship do they have with them? How about their spouse’s parents?

At the end of the day, it’s about having an authentic desire to understand your client’s story. For clients who have major life changes on the horizon, ask follow up questions to better understand how these changes could impact their financial planning.

A simple start would be:

Tell me how you think that might impact your planning?

And then be quiet and just listen.

Logically, every client knows they need to save more. But why haven’t they been able to do that to this point? What’s getting in the way?

Understanding the story behind your clients’ current financial situation and helping them connect emotionally to their goals is how you’ll help them get where they want to go.

So, make sure you dig deep in your next client meeting. Seeing the movie vs. the snapshot is the key to doing what’s right for the client – and it’s what’s needed to take your practice to the next level.

The key to prospecting is all about generating high quality referrals – this means asking for them on a consistent basis.

However, most reps only ask for referrals in some of their meetings. First, they “feel” out the meeting to see if there is a positive connection.

Then, based on how they are feeling, how the meeting is going and the odds of being exposed to social rejection, they determine whether or not to ask for the referral.

When they forgo asking for the referral, it’s attributed to reasons such as:

“I don’t know enough yet.”

“I don’t deserve referrals.”

“I haven’t added value yet.”

“I feel my clients would be doing me a favor.”

These attitudes are disempowering and will defeat you before you even get started.

It’s critical to your success to rise above this self-defeatist mentality and replace it with an empowered mindset. There are three keys to the empowered mindset.

The first key is your own honesty and integrity. The second you walk into the room with your clients, you have to leave your own needs at the door.

It is not about meeting your quarterly goals or qualifying for your next incentive contest. It’s about having a genuine and insatiable appetite to help better your clients’ lives.

When you approach your clients from this mentality, they can feel it. It’s incredibly attractive and it makes it far easier to ask for the referral.

Financial planning is not a logical business.

It’s not as if you can take a fact finder and your clients instantly realize that they need to save more money, increase their life insurance and fund a 529 plan for their children’s education.

These steps often make all the logical sense in the world, but we are not in a logical business.

Therefore, the second part of the empowered mindset is realizing that you bring tremendous value to your clients simply in the questions you ask.

This means going beyond asking for their name, date of birth, income, and assets and filling out the fact finder.

Instead, it requires authentic, thought-provoking questions, being 100% present in your meeting and truly listening to their answers.

While I challenge you to come up with your own, one question that I used in my fact finding process was, “In your early years, what did you learn about money from your Mom and Dad?”

After I’d ask the question, I’d stop, listen and ask clarifying questions. This created a new and powerful experience. Simply by asking this question, you are providing your prospect an opportunity to think through their answer and how it impacted their lives.

And that’s just one question – by the time you finish a fact finder, you’ve hopefully asked 10 more just like it. And that brings tremendous value.

"A real referral is when someone introduces someone they care about to someone they trust."

You must believe that your client’s referral to you is an enormous opportunity for them to impact the people they care about. It is not a favor to you.

We all have experienced moments when someone arrives in our lives and has dramatically altered the course of it for the better. This is your client’s chance to have that effect.

They should carefully think through the most important people to refer to you. And when they do introduce you to someone they deeply care about, you can take comfort in knowing that you will give them your absolute best.

This mindset is a dramatic contrast from the negative thoughts of:

“I know you’re not going to want to do this… I’m really worried about asking you for the referral because I haven’t sold you anything.”

“I’m nervous that if I ask you for a referral, maybe you’ll be so turned off by it that you won’t want to work with me going forward.”

“I know this business has a bad stereotype, but please just give me a chance. Maybe after a few years they’ll grow to trust and like me…”

We all have the empowered mindset some percentage of the time. But, when a prospect hangs up on you, someone doesn’t take your advice or you miss your goals, it’s really easy to get into a negative mindset. Conversely, when everything is going right, an empowered mindset comes naturally.

Your challenge is to work towards more consistently living with an empowered mindset, regardless of your day-to-day experiences. Reflect on the three keys to this mindset and remind yourself of them before your meetings.

Most importantly, act on it! Make a commitment to consistently ask for the referral, with the goal of doing it every time. Action is the best way to reinforce your beliefs and is what will allow you to reach your full potential.

When you’re phoning for new client meetings, handling objections is an essential skill.

When you master your ability to respond to objections in a confident, professional manner, phoning will become more enjoyable and effective.

There are only a handful of objections you’re going to get in your entire career. You’ll get them thousands of times and they should never throw you for a loop.

The key is to be prepared for these objections by knowing and practicing how you’ll respond when they arise.

One of the most common objections you’ll hear from people is that they aren’t interested in meeting right now. This is just their natural first response to being asked.

So, for instance, let’s say you’ve just gone through your script and requested a meeting with a new potential client. You’ve leveraged your nominator or referral, who in this instance we’ll call “Mary.” But, your prospect replies that they have no need for a financial advisor right now.

This will be an objection you’ll face frequently and you should be prepared.

I would reply:

“Listen, Mary had no reason whatsoever to assume that you had a need, nor did I. Things have a way of changing over time. She simply suggested that it would be a great use of our time to get together.”

“Having said that, I know you’re in BLANK (location). If Tuesday doesn’t work, is Wednesday at 1 PM or 3 PM better for you?”

What I am saying is this: I don’t care if you have a need or not. Mary (the nominator) doesn’t know if you have a need or not. However, that’s not why I’m calling. I’m calling because Mary wants us to meet and I’ve heard great things about you.

The mindset behind the language is that this will be the seed of a future relationship.

Another common objection is that they already have an advisor. To this objection, I would simply say:

“You know what, Mr. Prospect, I would be shocked if you didn’t have one already. Mary spoke of you as an individual of extremely high caliber, and I expected you would already have an advisor."

"What I’ve found over my career with people that already have an advisor is that after they meet with me, one of two things will happen. First, when I open up the hood and look underneath it, you’ll get the recognition and validation that the individual that you are working with is doing a great job and you’ll feel that much better about it.”

"Or, second, I may identify some needs that perhaps your existing financial advisor hasn’t recognized and they find that important as well. So the way I look at it, Mr. Prospect, is that neither outcome is a bad one. Therefore, if Tuesday at 1 PM is bad for you, does Wednesday at 2 PM or 4 PM work better?”

Once you have your responses to handle your top objections, you need a little intestinal fortitude and guts to be able to go all the way to three objections with every single client you call. It may not feel natural and that’s why practicing is so important.

People are programmed to say no the first time and for most people, even the second time. Successful people appreciate somebody who has passion and has a relentless pursuit for what they want. Believe it or not, it’s more of a turn-on than a turn-off – as long as you’re professional.

I cannot tell you how many of my best clients I landed after going to the third objection.

Once you’ve gone through three objections and the answer is still “no,” I’d say:

“Mr. Prospect, things have a way of changing over time. Would you have any objection if I kept in touch with you every six months?”

98% of the time they say, “No problem,” so you put them back in your system and you call them every six months. I had a lot of fun with people that I would literally have to call for four or five years before they would give me a meeting.

I’d say, “Guess what time it is?” and we would laugh. After enough of these follow-up calls, I’d finally just break down that you have to make choices. I couldn’t continue to call them year after year unless they were willing to meet.

That’s just one example of creativity to put you into the spot where you can get the appointment.

Successful people are willing to do the things that unsuccessful people won’t do. Mastering your language and being relentless in pursing appointments with potential new clients will set you apart, and your results will show it.