There are a number of things you can do to manage your calendar and time more effectively.

However, I believe there is one thing in particular that can have the greatest impact. While conceptually it’s simple, it is something that is a struggle for many reps and can be a major detriment to their productivity.

What I am talking about is saying “no” more often.

Every single time you say “yes” to something or someone, you are making a tradeoff. You are simultaneously saying “no” to something else.

For example, let’s say you agreed to meet with a potential client. This is a client that you’re not very excited about meeting. In order to meet with this individual, you have to drive to a location that’s an hour away, meet with them for an hour, and then drive back home.

You’ve now invested three hours of your time into this meeting. On the surface, it may look relatively harmless, but remember that by saying “yes” to the meeting you’ve also said “no” to something else.

In this case, you’ve said “no” to anything else that you could have been working on during those three hours, such as phoning for A+ clients, conducting additional market research, or brainstorming new business ideas.

Why do reps make the decision to take meetings that they feel are not going to be a great use of their time?

The reason is that they are coming from a scarcity mindset. They believe that there’s a very limited number of potential clients who are available to meet with them. They feel compelled to meet with whoever will give them a meeting!

The opposite of this is an abundant mindset. With this mindset, reps believe that there are plenty of potential clients available to see that they would be excited to meet.

Under this mindset, you can manage your time and your calendar because you are no longer subject to the whims of potential clients. You’re in control and you make the decisions about what you will and won’t do based on how you’ve set up your calendar.

I challenge you to begin to think about how often you say “no.” Start paying attention to it and tracking it. In addition, when you do say “yes” to something, begin to pay more attention to the tradeoff – what are you forgoing by saying “yes.” By simply bringing more intentionality to this simple act, it can have a big impact on your productivity and also make your workday more enjoyable.

[wd_hustle id=my-newsletter! type=embedded]

We’ve all been there before: You meet with a prospect or client. You make a recommendation for a particular product that makes all the logical sense in the world, and yet the client decides not to buy.

It’s important to have a system to follow up with these individuals moving forward, but prior to that, it’s more important to understand why they didn’t make the purchase in the first place.

If all you do is work in a logical world, you’ll never understand why people don’t buy. You have to understand that this is an emotional business and go beyond the superficial responses to get to the real reasons.

Think about it: You meet clients. They tell you their goals. You have all their facts and financial information. You know they have a need for your product or service. You know you have a great company behind you and the people to put everything together.

So, why wouldn’t they move forward with your plan? They must be crazy, right!?

While it may make you feel better to think that way, the truth is that they probably have a really good reason why they aren't doing it. The question is: Do you know what it is?

Do you know their reason? Have you asked the questions that help you go beyond the numbers and understand their real story?

For instance, imagine you have a 42-year-old, married male who is drastically underinsured and needs to purchase additional life insurance. It’s obvious to everyone. But what happens if he’s on the brink of going through a divorce and you didn't have a clue?

Many times you’ll meet with people who are not going to buy from you. But, by understanding their story, truly seeking to understand them, you'll at least know why.

Remember, people buy for their reasons, when they are ready – not for your reasons. As the old saying goes, “When the student is ready, the teacher shall appear."

The way that you make luck predictable is through your activity. Having a system that keeps you on track to create an abundance of activity is what is really going to bring that sustainability to life.

If you embrace activity and approach all your clients by leaving your needs at the door, the time will come when prospects and clients are ready to work with you. Every month, people will buy from you. It’s just that you don’t know which ones will do it ahead of time.

One of the practices that I had in place was a follow up system for clients and prospects who didn’t buy. If I left everything on the field and someone didn't buy, I would put them back in my system. Every six months they would come up, I would call them and it would be timed based on their birthday. I would call them on their birthday and six months after their birthday.

In my early years in the business, I read an article in a financial planning journal about a poll conducted among a group of clients. The poll asked clients to name the top five things they disliked about their financial advisors, and the clients’ top complaint was that advisors only called them when they wanted to sell something.

You know the old saying, “the truth hurts”? That really hit home with me, because not only did it sound bad when I read it, but upon examining my practice it rang true. I was guilty. I was cherry picking and didn’t want to waste my time.

I knew I needed to make a change, so I instituted the birthday call. It turned out to be one of my greatest decisions, simply because it not only defied the “truth hurts” principle, but it also became something I found incredibly enjoyable.

It's critically important not to discuss business, nor ask for referrals, on the birthday call. The purpose is to strengthen the relationship by getting to know them better and to differentiate yourself from other advisors. If the client asked about anything business related, I would simply say, "We can address that at our annual review in six months. That was not the purpose of this call. I simply wanted to wish you a happy birthday, catch up with you and let you know how much I appreciate our relationship." That really stood out because it was totally different from what was expected.

Six months later, I would follow up again. Some of my best clients it took me three, four, even five years before they purchased anything.

If I was calling up “Bob” and I've called him for three and a half years, we've met a couple times, and he had not moved forward with any recommendations yet, I’d continue to call him up every six months. I’d have fun with it. I'd say "Hey Bob!! It's your favorite guy, Jim Effner again. I bet you've been dying to hear from me! How's it going?!"

Really good sales people have the ability to break tension and reaching out to a client in that manner worked effectively for me.

It’s no secret that to be successful in this business you’re going to have to deal with your fair share of rejection. When your intentions are to understand your clients, make a meaningful impact in their lives, one client at a time, you learn to let it go. Have the courage to continue to follow up with the individuals that would make a valuable addition to your practice and I am confident that this system will work for you, just as it did for me!

[wd_hustle id=my-newsletter! type=embedded]

You just had a successful fact-finder discussion and your clients are coming back for their first planning meeting. Right off the bat, it is important to put them at ease and show them the true financial professional you are. How should you open this critical meeting to continue the momentum you made during the fact finder?

I found the best way to open the planning meeting is through summarizing. I refer to this brief summary as the introduction to the plan. The first purpose of summarizing is to review and clarify everything discussed in the previous meeting. The second goal is to prove to the client that we listened effectively during the first meeting.

In other words, we should demonstrate that we have successfully captured all the factual and emotional information expressed to us in the fact finder discussion. Once we’ve provided the summary, the client should feel we have a better understanding of them and that we truly listened.

Let’s begin with the way I prefer to deliver an introduction to my summary. I use the following analogy:

“Mr. Prospect, as we go into this plan, one of the things you are going to learn is what it will take for you to get an ‘A’ in each section of the plan.”

The reason I prefer this approach to begin the summary is that most clients can remember their school days and recall their desire to earn an “A” in every subject tested. Next, I explain that very few of my clients have an “A” in every aspect of their planning, but that I believe it’s my job to help them understand, at least initially, what it takes to achieve an “A” grade.

Once you have opened the meeting and tapped into your client’s desire to succeed, you need to provide a convincing summary, encompassing every topic discussed in the fact finder interview. But don’t make the mistake of believing that you should bury the client in “facts.”

Most reps fall into a trap at this point by taking an overly logical approach to a process that involves very little logic on the part of the client. Clients are not fact-seeking automatons, because most of their buying decisions are emotional.

Reps must connect with clients on an emotional level, and then utilize that connection to solve logical problems. Therefore, before going into the plan, I try to touch on some emotional elements we discussed during the fact finder interview. These could involve personal feelings related to childhood experiences or perhaps adult experiences involving parents or other relatives.

Consider a hypothetical case where the client informed us they wanted to retire at age 65, while having a steady income thereafter to maintain their standard of living. You could give an overview of their IRAs, 401(k), the current balances, and projected growth.

However, I would not stop there. I would also discuss their goals based on what the client shared with me. Suppose the client told me his in-laws lived a comfortable retirement while his own parents struggled and eventually needed financial support due to lack of planning. I would remind him of the critical importance he attached to living in retirement like his in-laws rather than his parents.

This approach is a vital part of the summary, since it effectively used the information I gathered from the fact finder to connect and strike a chord with the client about their parents’ past financial difficulties. By connecting at this level, the client realizes how critically important it is to not repeat those failures, with me leading the way as their financial guide.

The lesson I’d like to emphasize is the importance of connecting through personal stories and understanding emotional issues before presenting logical solutions to a client’s financial concerns. Therefore, those emotional touches are an absolute necessity in the summary.

The next step in the summary is to help clients understand that your job is to ask all the necessary questions, listen to their responses, and gather precisely accurate information. The entire purpose of the plan you are about to present is to help them better understand the steps necessary to achieve their financial goals.

This is a crucial point because many clients assume that the financial advisor intends to use the plan to manipulate them into buying something they don’t need. Stated another way, my kind of plan is developed through strategies the advisor feels are important for the client, as opposed to the other way around. You need to communicate to the client that the plan is based on what they told you.

To wrap up your summary, briefly describe the overall areas you will cover, so your clients have an idea of where the discussion is going before you open the first page of the plan.

While any rep can begin with a summary in their planning meeting, it takes time and practice to master delivering one. Remember, the real work of delivering an effective summary takes place beforehand, during your fact finder meeting.

You have to be an active listener, ask the right questions and follow up with additional questions. Go beyond the numbers. Once you really understand both your client’s financial picture and their personal story, the summary practically builds itself.

[wd_hustle id=my-newsletter! type=embedded]

In the last post, I gave you three reasons for why it’s critical to conduct an annual review with all of your clients.

It makes sense from a client perspective as their financial needs change over time, but it’s also really important to your business.

In this post, you’ll gain some practical ideas on how to schedule the annual review meetings with your clients and overcome potential objections.

Everyone has his or her own idea as to how to approach setting up the annual review. In my practice, I called all new clients from referrals and any others I wanted to meet for the first time. My staff called all existing clients in my system for the annual reviews.

Their language should be very simple. Your staff does not want to deal with conflict, and they aren’t salespeople, so it should simply sound like this:

“Hello, Mr. Prospect, this is such-and-such, Jim Effner’s assistant. I just wanted to let you know that it’s time for your annual review, and I was wondering if next Tuesday or Wednesday would be better for you at 2 o’clock in our office.”

The client can schedule a time — or they may make up an excuse. The first time they often make excuses.

“Well, nothing has changed. I don’t need to get together with Jim now.”

“I’m really busy.”

“I’m not interested now. I’ll see him next year.”

“I don’t really see any benefit right now.”

Before teaching you how to deal with that, I want to teach you to be very introspective about what clients are actually telling you. What they’re saying is they don’t see much value in what you bring to the table.

If a client only wants to see you when they need to purchase a product from you, this indicates that they do not view you as an advisor, but as simply a sales person who distributes product.

In these cases, my assistant simply says, “Okay, why don’t I have Jim follow up with you?”

Those files are brought to my office, and I personally call those clients. I say something like this:

“Mr. Prospect, it’s Jim. My assistant called you and mentioned that you weren’t interested in getting together for an annual review. I wanted to follow up and see what was going on in your mind.”

About half the time, they would say, “You know what? I thought about it. Let’s get together.” The change came simply from hearing my voice.

However, they might proceed by repeating what they told my assistant. I simply reply with:

“You know what, Mr. Prospect? I apologize. Maybe I didn’t make myself clear when we first met, and I told you that it’s a very important process in my practice for me to get together with clients each year for an annual review.”

“The reason for that is because I take my responsibility seriously, and I need to build a relationship with my clients. Things change in life, both in family and finances, in careers and objectives and goals.”

“If I’m not together with my clients on an annual basis, I don’t feel I can do my job. I’m not interested in only whether things have changed or whether you need to do anything. What I’m interested in is building a relationship with you and helping you achieve long-term financial security. Having said that, what time next week works well for you for your annual review?”

If they push back after that, I have a very direct conversation and inform the client I’m no longer interested in working with them.

See, when you say you stand for something, you have to be willing to fall on your sword for it when tested. If not, you don’t truly stand for your principles. This is where the rubber hits the road on your value system.

From my perspective, if someone is my client, I will do the best job I possibly can, and they’re damn lucky to have me as a financial rep.

If they’re not serious enough about their planning to sit down with me just once a year, I’m no longer interested in being their financial representative.

When I share this with reps, it blows them away, but I promise you will experience a transformational amount of growth through this perspective. The first time you fire somebody, you will feel like a million bucks. Carry that self-confidence with you. It’ll pay back in spades.

I did that once with the client, and every year after, they scheduled the annual review with my assistant. It is typically only with a new client on the first annual review call, that you may have to push for a meeting. Even then, that will only be occasionally.

Once you have this system in place, you’ll find the process runs smoothly and that the majority of annual reviews are easily scheduled.

[wd_hustle id=my-newsletter! type=embedded]

One of the practices that I teach is that you should meet with each and every one of your clients for an annual review.

Clients’ needs evolve as they change jobs, grow their family and plan for retirement. If you’re going to be their go-to advisor for the long haul, your plan must evolve over time too.

While this makes perfect sense from a client perspective, I’ll share with you a few reasons why it makes sense from a business perspective.

Reps often don’t have a systematic way of getting in front of people. Worse, they meet with a new prospective client and work desperately to get them to buy something. Then, if they don’t buy anything, they throw the potential client away.

That is a cardinal sin in this business. One third of your clients will buy two to three years after the initial meeting. (Two thirds of your new clients will buy in the year you meet.)

By throwing potential clients away when they don’t buy, you’re missing a third of the people you could potentially sell. That’s a statistic worth remembering.

Second, if you successfully sell somebody, but they fall through the cracks in your system and you’re unable to get back in front of them, you’re missing a grand opportunity.

Statistics tell us that the average client will buy your core products seven separate times — that includes the risk management products such as life insurance, disability insurance, annuities, and long-term care.

Although it might not be politically correct, I like to make the analogy of when someone has a great first date and then goes in for a kiss. That first kiss is always awkward, but after that it becomes an afterthought.

It’s the same with a new client. It takes approximately 23 hours of effort, eyeball to eyeball, to land a new client - but the second sale takes less than three hours. Every sale after that requires slightly less time as you build a relationship. Build trust and it will be far easier and faster to implement your planning.

So, we want to use that knowledge to our advantage and make sure we capture all seven of those sales. Your best clients will buy 12 or 13 times from you, so failing to have any systematic process to get in front of these people is a tremendous mistake.

The second statistic I want to share with you is so fascinating that most people don’t believe me at first. It relates to risk management products and the underlying premium sold in those products; every single sale is greater in premium than the summation of all the previous sales.

Let me offer an example. If you’re selling somebody for the fourth time, on average the premium of that fourth sale will outweigh the premium of the first, second, and third sale combined. Now, I know when you read that, you’re baffled and probably don’t believe it. Allow me to explain.

As it relates to selling risk management products, the lower-end premium products can be bought simply through logic alone.

For example, if you meet a young family with no life insurance and you help them understand the necessary amount of life insurance — let’s say that’s $1 million on the breadwinner and $250,000 on the stay-at-home spouse — it’s a logical decision to buy that in term insurance. At a very low premium, they’ll pull the trigger on that rather quickly.

However, to persuade them to buy a big chunk of permanent insurance and spend thousands of dollars on annual premiums, that is accomplished through building trust.

Trust is earned over time, so life insurance clients are much more prone to buy term insurance early on, before converting to permanent insurance as they begin to trust the advisor. That’s why the premiums get bigger and bigger as time goes by.

Now you can imagine by these stats alone that, if you lack a process to get in front of your clients on a systematic basis, you are missing a tremendous opportunity. I often equate this mistake to reps banging their head against the wall over and over. Without a system to get in front of your clients, each successive year is like your first year in the business.

One of the multiple beauties of this business is that it’s designed to get easier year after year. If you fail to embrace this concept, you are not taking advantage of that fundamental principle, and it is time you change.

On a final note, a key to implementing this process is limiting your book of business to a manageable size. To learn more about why and how to do this, see this article on defining your book of business.

[wd_hustle id=my-newsletter! type=embedded]

With today’s technology and caller ID, you’ll reach referrals on new prospective client calls only 20% of the time.

It’s not because they’re not there when you call. Rather, it’s because they don’t recognize your number. They’re not waiting for your call, and you did not get the right nomination.

Or, it could be instead that you called the wrong number—perhaps you have a work line instead of a cell phone, or you have a cell phone instead of a work line.

Regardless, they didn’t answer. Now, you're left hoping that the voicemail you leave is enough to bring your first meeting to fruition.

On average, you should make appointments with new prospective clients 50% of the time when you reach them. Using these numbers, if you make 30 phone calls in an hour, you would most likely have six conversations. That’s 20% of the 30 calls.

Out of those six conversations, you should end up with three appointments from those six, which is 50%. It’s important to know and track those numbers, because that determines whether your efforts are working.

However, how should you handle the 80% of the individuals that go straight to voicemail? Here are two “tricks of the trade” that you can use to help reach your monthly targets. One is on leaving messages and the second is on confirming appointments.

A lot of reps ask me, “Hey, how often should I be leaving messages?”

That’s somewhat of a gray area. You certainly don’t want to leave more than one message per day, because it may look as if you’re stalking them. You probably don’t want to leave a message more than once every three business days, but you’ll have to play with that and see what works best for you.

When you do leave a message, here is what I find works the best: If Mary Jones referred me to Bill Smith, and I needed to leave him a message, I would say:

“Hey, Bill, it’s Jim Effner, financial advisor with such and such company. I’m calling on behalf of the nomination I received from Mary Jones. I believe she’s already reached out to you and told you I’d be calling, but do me a favor if she hasn’t. Please pick up the phone and give her a call first. She’ll bring you up to speed with what this is all about, and then go ahead and call me. Here’s my number. I can’t wait to hear from you.”

That tends to force a conversation between the referral and the nominator, and I find that works well.

When leaving a message to confirm an appointment, you should assume consent. The only reason you’re calling is to clarify the address.

Thus, if I’m calling Bill Smith to confirm an appointment tomorrow in my office at 2 o’clock, I don’t call him and say, “Hey, Bill, it’s Jim. I just want to make sure we’re still on. Are we still good?” This approach gives them an out.

Instead, I leave this message, “Hey, Bill, I’m super excited about our meeting. I can’t wait to meet you. I have heard such great things about you. Our meeting is at 2 o’clock, but I couldn’t remember if I gave you my address, so I simply want to get back to you. Again, here it is. See you tomorrow!”

That is a much more effective way to confirm appointments, as opposed to asking them if you’re still meeting.

Always remember that the only purpose of phoning is to get an appointment. It’s not to sell financial products or yourself.

When you have that mentality, your messages become succinct, clear, and compelling, which allows you to place significantly more calls per day. It also allows you to project a professional and energetic tone to your clients.

Lastly, understand that if you never get in front of a client, nothing will happen. However, if you successfully get in front of a client, you can change their life.

This mindset will provide the intensity needed to be far more effective while phoning referrals, leaving messages and confirming appointments.

[wd_hustle id=my-newsletter! type=embedded]

Last Sunday morning, I was enjoying my cup of coffee and watching a CBS program called, “The Money Issue.”

The topic of the show was on the age old question of whether money can bring someone happiness. We all know the positives that money can bring to one’s life. But we also know the challenges of earning and managing it can create tremendous stress and anxiety. It can make people feel like they are a slave to it.

I have seen these feelings manifest in various ways; in my personal interactions with family and friends and throughout my nearly 30 years of being in financial services. The bottom line is that money is one of the top areas of pain in many peoples’ lives and the wrong decisions about it can lead to health issues and family problems.

As I was watching this program, I started reflecting on my last couple of weeks with my Sales Cycle Mastery participants.

One of the things I have been challenging reps in my program to do is to think about what makes them different. Why should people buy from you compared to someone else?

I ask them to go beyond just thinking about it and to sit down with a pad of paper and start writing down their thoughts. Find a way to word smith it so that when you articulate it to your clients, it is full of D.N.A. – it’s Different, New and Attractive.

Now, when you think about money being a HUGE problem in our country in its ability to generate stress, it grabbed my attention as an opportunity for financial reps.

You engage in a lifelong journey with every one of your clients where you slowly, but surely, reduce the amount of financial stress they face each day. You accomplish this using a three-dimensional approach.

First, is by helping your clients by develop the right financial behavior. Second, is by building a sound risk management foundation to eliminate the stress of the “What Ifs.” And third is through designing a plan to accumulate assets and build peace of mind.

Here’s how we can break down those three aspects of this approach a little further:

1) Develop the right financial behavior. Think about all the financial decisions that people make that hurt them: spending too much on their house, buying too many cars, spending far too much on their children simply to “Keep up with the Joneses,” frivolous spending or gambling, not committing to saving early enough to take advantage of the compounding of the dollar...

By slowing down, seeking first to understand your clients and really getting to know them, and asking questions and great follow up questions, you can help them avoid these critical mistakes.

2) Eliminate the stress of “what ifs.” Most people never think they’re going to need insurance until it’s too late. Yet, it’s no secret to those in the industry how the failure to have the proper insurance in place during a time of an accident, a disability or a death can be devastating.

By sharing the knowledge you have, you can show your clients that insurance doesn’t have to be painful and a large financial pit. We understand just the opposite. With the appropriate risk management portfolio, it can not only take the financial disaster away early on in life if a disability or death occurs, but it can also provide tremendous peace of mind to the long-term needs of retirement.

3) Accumulate assets and build peace of mind. There are all kinds of issues that can arise on the road to wealth accumulation: making irrational decisions at the wrong time, doing it alone with no cohesive professional advice, purchasing bad products with unnecessary tax penalties, reaping the consequences of a short-term mindset.

These are decisions that are founded in worry and fear. But by developing a well thought-out, individualized investment plan and working with your client on a regular basis as their advocate, coach and support figure, you can help them feel safer and more secure every year.

From New York to California, from the middle market to the affluent, money brings a huge amount of stress to most Americans. Yet, as a profession, we spend too much time talking about the drill bit and not enough talking about the hole!

We must change our mindset from that we “sell insurance and manage money,” to that we are financial advocates, coaches and therapists. Over time, we help clients develop the right financial behaviors, reduce their stress and grow their peace of mind. Now, that’s Different, New and Attractive and something that everyone wants.

[wd_hustle id=my-newsletter! type=embedded]

Disability, like death, is never a fun subject to think about. But as a financial advisor, one of your missions is to help make your clients financially bulletproof, and disability insurance is a critically important aspect of their plan.

Most people rarely think about disability insurance. They look at it the same way they look at their health insurance, which they have through their employer and therefore feel good about their coverage.

However, as financial advisors, we all know that the group disability through an employer is better than nothing, but it’s rarely ever enough to cover most monthly household financial commitments.

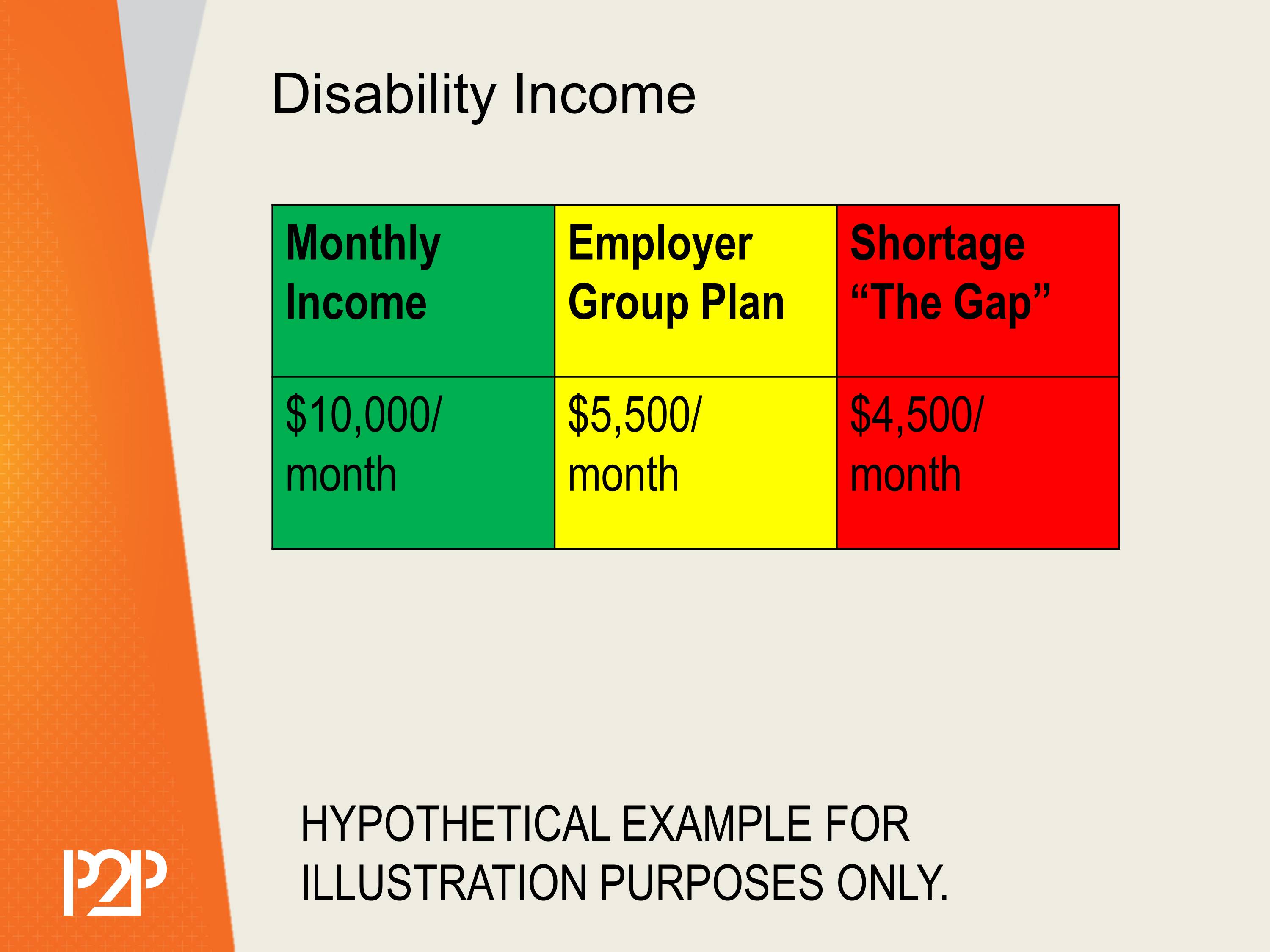

In my disability income planning process, I use a very simplistic approach. In a three-column spreadsheet, I use green figures in the left-hand column to illustrate the client’s net monthly income (after-tax and all deductions). Let’s say that figure is $10,000.

The next column, in yellow, displays the net amount coming into their household in the event of a disability, after-tax, through their employer group plan - let’s say $5,500.

The third column, color-coded red, shows the shortage between their group plan and their healthy ordinary income. Hypothetically, that number is $4,500.

With that amount presented, I’d say: “This green column is what you’re making now. In the event of a disability, this yellow column is what your household would receive, and therefore this red column is the Gap, which I see as a concern. Tell me before I move forward: How do you feel about that?”

This is where the rubber hits the road. Your goal is to make every one of your clients bulletproof, and if they don’t have adequate disability coverage, you must help them understand a vital fact: disability is more likely than premature death.

This fact can shock and upset them, but that kind of emotional response to the facts can propel them into action.

At this point in the process, I tell clients that there will be numerous components of the plan that are fun and exciting to discuss, but those come only after we hit our basic goals. I show empathy at this point by acknowledging that disability insurance is not fun, it’s more of a necessary evil. It’s as important as homeowner’s insurance or car insurance, which most people have, so I help them understand my conviction on this matter.

I also make clear that there are other problem areas in their disability planning besides the Gap in the graphs I highlighted. I inform them that most group plans have no index for inflation, so in the event of a long-term disability, the purchasing power of the dollar from their benefit will go down every year.

But as a financial advisor, one of your missions is to help make your clients financially bulletproof, and disability insurance is a critically important aspect of their plan.

I also help them understand that most group disability does not cover beyond six months the cost of medical insurance, and I discuss the added cost of that aspect. Furthermore, I talk to them about having no contributions to retirement plans so, in the event of a long-term disability not impacting life expectancy, their life beyond 65 suffers because the group disability goes away, resulting in inadequate retirement funds.

I cover all these aspects of the disability section before moving forward. I explain that, looking at their situation, it seems obvious that they should at least be educated about the definitions and costs of a supplemental disability policy. I ask if we are on the same page and then remain quiet until they confirm. Otherwise, I’m probably not going to proceed further.

Then, I address any issues or questions they have. One example might be:

“Jim, I’m a lawyer. I work at my desk. If I were disabled, I could just come to work because it’s not like I’m laying concrete. So, that’s not really a concern of mine.”

That would be an instance of an individual not relating to the real potential of a devastating disability. I would reply to the client:

“Mr. Prospect, I can understand and appreciate your position. I work almost exclusively in a white-collar world. Many of my clients feel the same way when we first meet. Having said that, let me ask you a question: When did you last have a 103° temperature or a bad case of the flu that prevented you from working?”

Posed that question, they quickly understand that, in the event of disability, whether it be a mild sickness or cancer, the last place they want to be is at their workplace. I simply remind them that great planning is all about having options. My job is to make sure you don’t have to go to work feeling miserable. With a small disability insurance premium, the option exists. Most of my clients grasp the concept when described to them in this manner.

Disability can be financially devastating to a family when it happens, and I believe everyone in this industry has an obligation to address it with their clients. In my practice, I made a commitment to myself to talk to every single client about disability insurance. To the extent that they chose not to take action, I would let it go, but I would make detailed notes in the case file that I did so.

This allowed me to sleep easy at night knowing that every client I worked with was educated about the risk and had an opportunity to put a plan in place.

[wd_hustle id=my-newsletter! type=embedded]

I recently read an article in a well-respected industry magazine that was on how to become a better prospector. The article provided 12 prospecting ideas for top producers that included cold calling, advertising, mailers and teaching seminars, among others.

While this provides a quantity of prospecting ideas to consider, there’s only one I would focus on. No, it’s not the latest social media strategy. Nor is it networking, billboard advertisements, TV commercials or direct response mailings. It requires no new technological innovations or knowledge. It's simply generating referrals.

As an advisor, I used referrals and favorable nominations almost exclusively to build my business and earn lifetime MDRT qualification. I knew that if I could get a client or prospect to speak glowingly about their experience with me to their closest friends and family, the likelihood of them agreeing to meet with me would be high. And, if those individuals would meet with me, then I could have a beneficial, life-changing impact on them.

Skeptics may read this and think to themselves, “this is old fashioned,” or “this sounds great, but it’s really challenging to get prospects and clients to tell my story to their friends and families.” In fact, the challenge of getting clients to “share my story” is exactly one of the cons listed in the magazine article for generating referrals.

However, this is the wrong thought process. I never want my clients to tell my story to their friends and colleagues. I want my clients to tell their story to their friends and clients.

This is not a mental trick. It’s a completely different mindset that must stem from an authentic belief that’s deep inside your core.

Here's the mindset that I carried with me when asking for referrals:

The majority of people need financial planning help in big way and I have a systematic process that I believe in that provides this service.

I bring integrity, honesty and trustworthiness to my relationships.

I help people think about things they’ve never thought about in a way they never have before.

I give them an experience they will truly appreciate. When I ask for referrals, I want them to tell the best people they know, the ones that they care about the most, about the experience they had working with me and to suggest to them that they have an open mind about the opportunity of doing the same.

I want them to be able to honestly say that it would be well worth their time and a big mistake not to do it.

That’s a strong nomination.

I often say that we are not in a logical business. We’re in an emotional one. I can apply that principle to nearly every aspect of this business and it always seems to be true, and it is for this topic in particular.

If advisors could get referrals and they were all well nominated, who would cold call? Who would spend money on advertising? Who would do mass email campaigns to book appointments? Nobody, logically. However, there’s a few reasons why the majority of the industry uses those inefficient methods every single day.

It’s because of fear. It’s because of insecurity. And, it’s because of an inability to overcome self-conscious thinking about what their clients will think of them.

I never want my clients to tell my story to their friends and colleagues. I want my clients to tell their story to their friends and clients.

There is a skill set and a system to becoming a masterful prospector. But, mastering both of those are easy when you have the right mindset – an empowering mindset.

When you have confidence in what you do for your clients, you'll then have the courage to be able to ask for referrals. When you understand that you’re in a noble career and are on a mission to change the world as it relates to financial security, your confidence allows you to overcome the fear of rejection.

When your intentions are to make a meaningful impact, one client at a time, you learn to let go of what some might think when you ask them for referrals. That’s their problem, not yours.

We are in a time when it’s never been more important to be different. It’s never been more important to get away from transactions and commoditization and focus on building intimate, meaningful relationships with clients.

When you do this, your clients will want their closest friends to experience the same and gladly share their story. And when you get a well nominated referral, you’ll start right out of the gate by being different in your prospects’ eyes, and separate yourself from every other advisor out there.

[wd_hustle id=my-newsletter! type=embedded]

One of the more difficult concepts for reps to grasp is that the growth of their book of business does not necessarily equal growth in their practice. In fact, in many cases, as their book grows, it can limit the growth of their practice and carry consequences for their clients.

Before we get into why, first you need to understand that your active book of business consists of two groups:

1) Clients who have bought something from you

2) Clients who have completed your fact-finder and have their information in your system

In other words, to be part of your book of business, they do not need to have purchased a product. Even the best of clients have different investment timelines. Sometimes it takes two or three years before they buy the first product from you and become a client.

The controversial area is how many people can be handled in your book of business. I’ll start by telling you that the number is not black and white. Some argue that it’s 400, some say 450, and others might even say 500 if they want to be super active. I’ve met many successful reps that claim the number is 350. The bottom line is that it’s a definitive number, and a point of diminishing returns kicks in once you exceed that number.

Reps often cling to the security blanket that comes with large numbers. If they add a couple hundred people to their system, they can easily be in the range of 2,000+ clients after a quick 10 years in this business. When I meet reps who have thousands of clients in their system and I tell them they need to get rid of three-quarters of them, the reps are usually stunned.

The problem is that they have no systematic process of getting in front of those people on a regular basis. The law of large numbers sits in the backdrop for them to cherry pick month by month, year by year. They sift through the files to figure out who they want to call based on who they think is most likely to buy the next product from them.

This is not only a highly inefficient way to run a financial planning practice, in my humble opinion, it’s also not in the best interest of the client. That behavior simply indicates that your business centers on you, not the client.

It has to be a two-way street - a commitment from both the client and the financial rep. Both parties must meet on an annual basis and relentlessly pursue the promised land of financial security. This becomes a handholding journey filled with challenges, encouragement, and education—sometimes tears and hopefully joy. It means going all in on the mission of having long-lasting, intimate relationships with your clients as you guide them to financial freedom.

Now that your client number is limited, you must be selective. If your limit is 400 and you sign the 401st client, you need to get rid of one. When you possess that mentality, you become very selective as to who you let into your database.

The challenge is that you should also never stop growing. You’re either green and growing, or ripe and rotting. Therefore, once you get to your number—for now, let’s say 400—you want to add those you are excited about to your system, while subtracting those from the bottom who no longer measure up. The quantity never changes, but the quality, measured by net income, net worth, future potential and the caliber of the individual, always increases.

Often, reps of high integrity struggle with this because they feel they are breaking a promise made to their clients. They feel guilty about getting rid of the ones at the bottom of the funnel. Although this sounds noble, by failing to do so they are causing their clients a disservice without even knowing it.

While they haven’t physically deleted the files of those clients, they have gone years without calling them. When other financial advisors call on them, they’ll say, “I’ve already got a guy.” Thus, they are doing them harm by preventing them from meeting other people who will be more in tune to their needs. This is a disservice, and it must stop.

There are several ways to take care of people you’ve outgrown. One way is to establish relationships with junior reps who are often thrilled to take on these clients. Second, you can create a client resource center in your network office. There, you can turn over client files to a staff member who will service them according to their needs. The third alternative is to find a replacement rep.

Upon deciding to remove these clients from your system, send them a letter informing them that you made a commitment to them and, if they have any future service needs, you’ve made appropriate arrangements. Explain that your commitment to service needs will forever be taken care of but, at this point, you see no need to continuously meet. And, if they feel differently, they are welcome to contact you directly.

Most will not respond. Of the thousands of separation letters I’ve sent over the years, less than 4% called with hard feelings. Most are relieved due to lack of interest in pursuing further financial planning services.

On a final note, it’s critically important that you carry the mentality of abundance, as opposed to one of scarcity. With the theory of scarcity, you’re desperate and feel the need to take anybody who will talk to you. The more, the merrier! This perspective brings a false sense of security and can limit your growth.

Instead, embrace a mentality of abundance! There are millions of people that you can reach, whether in a 50-mile radius of your home, or around the world. You can work globally via teleconferencing and videoconferencing. As a result, you must be highly selective as to whom you take as a client so you can go all in with each and every one of them.